The United Kingdom, a land steeped in history and increasingly embracing technological innovation, presents a compelling, albeit challenging, landscape for cryptocurrency mining operations. Beyond the romantic image of digital gold rushes, lies the crucial element of hardware selection – a decision that can make or break a UK-based mining venture. But let’s be clear, mining isn’t just about plugging in a machine and watching the digital coins roll in. It’s a complex equation balancing power consumption, computational capability (hash rate), upfront investment, and, critically, the UK’s unique regulatory and environmental landscape.

Choosing the right mining hardware begins with understanding the cryptocurrency you intend to mine. Bitcoin (BTC), the behemoth of the crypto world, demands specialized ASIC (Application-Specific Integrated Circuit) miners. These machines are purpose-built for solving Bitcoin’s SHA-256 hashing algorithm, offering unparalleled efficiency. However, this efficiency comes at a steep price. ASIC miners are expensive, power-hungry, and quickly become obsolete as newer, more powerful models are released. Consider the return on investment (ROI) carefully, factoring in electricity costs, which are generally higher in the UK compared to some other mining havens.

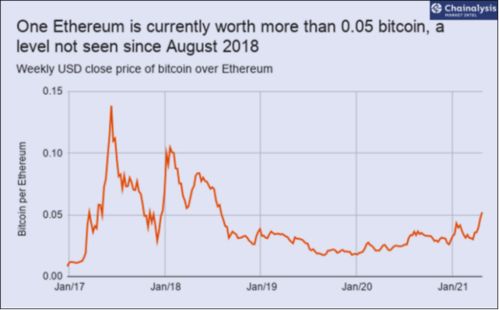

Etheruem(ETH), on the other hand, until its transition to Proof-of-Stake (PoS), was primarily mined using GPUs (Graphics Processing Units). While ETH is no longer mineable via traditional methods, other cryptocurrencies utilizing similar algorithms are still viable options for GPU mining. This offers greater flexibility, as GPUs can be re-purposed for other computational tasks if mining profitability declines. This adaptability is a significant advantage in the volatile crypto market.

Dogecoin (DOGE), the meme-coin darling, is another contender, although its mining is often intertwined with Litecoin (LTC) through merged mining. This means you can mine both currencies simultaneously, leveraging the same hardware. ASICs designed for LTC mining can also mine DOGE, providing a dual-currency income stream. However, the profitability of DOGE mining is highly dependent on market sentiment and transaction fees.

Beyond the choice of cryptocurrency, the UK’s environmental regulations are a vital consideration. Green mining is no longer a niche concept; it’s becoming an imperative. Sourcing renewable energy, such as wind or solar power, can significantly reduce your carbon footprint and potentially unlock government incentives. Furthermore, efficient cooling systems are crucial to prevent overheating and minimize energy waste. Immersion cooling, using dielectric fluids to dissipate heat, is an increasingly popular option, offering superior cooling performance and reduced noise levels compared to traditional air-cooling methods.

Mining rig hosting offers an alternative to setting up your own mining facility. Companies specializing in hosting provide the infrastructure, security, and technical expertise needed to operate mining rigs efficiently. This can be a particularly attractive option for individuals or smaller operations that lack the resources or expertise to manage their own mining farms. However, it’s crucial to conduct thorough due diligence before entrusting your hardware to a hosting provider. Consider factors such as uptime guarantees, security measures, and the provider’s reputation within the mining community.

The physical security of your mining hardware is also paramount, particularly in the UK’s urban environments. Secure facilities with robust surveillance systems and access controls are essential to prevent theft and vandalism. Insurance is another important consideration, protecting your investment against unforeseen events such as fire or natural disasters.

Effective monitoring and management are critical for maximizing mining profitability. Real-time monitoring of hash rates, temperatures, and power consumption allows you to identify and address potential issues promptly. Remote management tools enable you to restart or reconfigure mining rigs remotely, minimizing downtime and optimizing performance. Furthermore, staying abreast of the latest software updates and firmware upgrades is essential for maintaining security and maximizing efficiency.

Finally, navigating the UK’s regulatory landscape requires careful attention. While cryptocurrency mining is not explicitly regulated in the UK, it’s essential to comply with all applicable laws and regulations, including those related to electricity consumption, waste disposal, and environmental protection. Seeking legal and financial advice can help you ensure compliance and avoid potential pitfalls.

In conclusion, establishing a successful mining operation in the UK demands a strategic approach to hardware selection, a commitment to sustainable practices, and a deep understanding of the local regulatory environment. By carefully considering these factors, you can increase your chances of reaping the rewards of the digital gold rush while minimizing the risks.

Leave a Reply