In today’s fast-evolving cryptocurrency landscape, securing a Litecoin miner in the UK is both a prudent investment and a complex endeavor. Litecoin (LTC), often hailed as the silver to Bitcoin’s gold, demands specialized mining hardware tailored to its unique cryptographic algorithms. As markets expand and mining operations become more competitive, the savvy investor must navigate not only the nuances of mining rigs but also the intricacies of hosting solutions, fluctuating energy costs, and volatile currency valuations.

With the surge in popularity of cryptocurrencies such as Bitcoin (BTC), Ethereum (ETH), and Dogecoin (DOG), Litecoin has maintained a steadfast position thanks to its faster block generation time and lower transaction fees. This means that mining Litecoin is not just about raw power—efficiency and cost-effectiveness play crucial roles. Enthusiasts and professionals alike have realized that investing in robust, cutting-edge mining equipment tailored specifically for Scrypt-based mining algorithms—on which Litecoin relies—is essential for profitability.

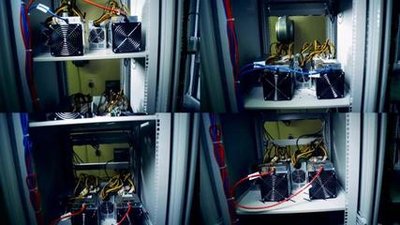

Once the right Litecoin mining rig is secured, the next challenge unfolds: choosing the ideal mining farm or hosting service. The concept of mining machine hosting has revolutionized how individuals participate in cryptocurrency mining. Rather than grappling with the logistical headaches of housing hardware—like cooling, security, and electricity—investors can lease space within specialized data centers. These mining farms offer scaled environments where power efficiency is maximized, and operational overhead is minimized, often translating into steadier returns for miners.

In the context of the UK market, energy economics are pivotal. The country’s higher electricity costs compared to other regions can squeeze behind-the-scenes mining profits. However, the UK also boasts increasingly green energy sources, such as wind and solar, which are becoming attractive for eco-conscious mining farms. This shift toward renewable energy hosting options is reshaping how Litecoin miners consider their operational footprint, aligning digital asset mining with sustainability goals to build long-term economic and environmental viability.

Furthermore, the UK’s robust cryptocurrency exchange ecosystem provides investors with unparalleled liquidity and ease of access. Platforms like Binance, Coinbase, and Kraken facilitate seamless conversion between Litecoin and a multitude of cryptocurrencies, including Bitcoin and Ethereum, enabling miners to diversify holdings or capitalize on market swings. The dynamic interplay among various coin valuations injects an additional layer of strategy for those involved in mining and trading, underscoring the importance of timely decision-making and market insight.

Innovations in mining technology also shape the investment landscape. From ASIC (Application-Specific Integrated Circuit) miners, tailored for maximum efficiency in mining Litecoin’s Scrypt algorithm, to advancements in modular rig design, the choices available today reflect a deep maturation of the industry. Early adopters who invested in outdated hardware have seen their margins dwindle, while those embracing the latest rigs often enjoy heightened hash rates and lower power consumption, crucial vectors in achieving sustained profitability.

Strategic considerations extend beyond hardware into the realm of market timing and regulatory awareness. The UK’s regulatory framework, though evolving, provides a relatively transparent environment compared to some other regions. Investors must stay abreast of potential changes in taxation, energy policies, and crypto-asset regulations to safeguard their ventures. This proactive vigilance ensures that mining operations remain compliant, scalable, and resilient to policy shifts.

On the frontier of the crypto universe, alternative coins like Dogecoin and Ethereum complement Litecoin’s ecosystem by offering diverse mining opportunities, each with unique algorithms and market dynamics. While Litecoin mining is specialized, an investor’s portfolio often includes stakes in ETH through Proof-of-Stake mechanisms or BTC mining ventures, creating a balanced exposure across major cryptocurrencies. This multifaceted approach mitigates risks and harnesses different facets of the burgeoning digital economy.

For the discerning investor in the UK keen on staking a claim in Litecoin’s promising future, the path involves an integrated strategy: secure cutting-edge mining rigs, engage with forward-thinking hosting solutions mindful of energy and environmental factors, and leverage the strength of the country’s crypto exchanges for dynamic asset management. In this confluence of technology, market savvy, and regulatory finesse lies the blueprint for smart cryptocurrency mining investment.

Leave a Reply