In the vast, ever-evolving landscape of cryptocurrencies, Bitcoin reigns supreme as the original digital currency. Its decentralized nature and potential for value appreciation make it an appealing investment and a robust choice for mining activities. As the price of Bitcoin continues to fluctuate, many miners seek ways to optimize their operations, particularly through hosting services and machine maintenance.

Mining Bitcoin is no small feat; it requires significant computational power and energy consumption. Enter the realm of mining machines and hosting solutions. These machines, often referred to as mining rigs, are designed to solve complex mathematical problems that validate transactions on the Bitcoin blockchain. When choosing a mining rig, one must consider not only its hash rate but also its energy efficiency. A well-optimized machine contributes to greater profits, as energy costs directly impact overall returns.

Yet, optimizing profit is not just about selecting the right hardware; it also involves strategic hosting solutions. Overhead costs can add up quickly when operating your own mining farm, including facility expenses, cooling requirements, and electricity bills. Many miners are turning to hosting services, which provide a more streamlined and efficient setup. By outsourcing maintenance and infrastructure, miners can focus on maximizing their operational output. This has become particularly relevant in the US, where some hosting providers specialize in Bitcoin mining, offering competitive rates and state-of-the-art facilities.

Moreover, ongoing maintenance is crucial for the longevity and efficiency of mining operations. Regular updates and servicing of a mining rig can prevent costly downtimes. It’s advisable for miners to monitor the performance of their equipment continuously. Utilizing software that tracks hash rates and power consumption can provide insights, allowing for timely interventions if a machine underperforms. By creating a routine maintenance schedule, miners can ensure their machines remain in top shape and achieve optimal performance levels.

When it comes to Bitcoin mining, the profitability also hinges on market conditions and mining difficulty. As more miners join the network, the competition heats up, making it essential to remain adaptive. Miners may want to diversify their activities by also exploring other cryptocurrencies, such as Ethereum (ETH) or Dogecoin (DOG). This allows for flexibility—if Bitcoin’s market declines, the miner’s portfolio remains resilient thanks to investments in other currencies.

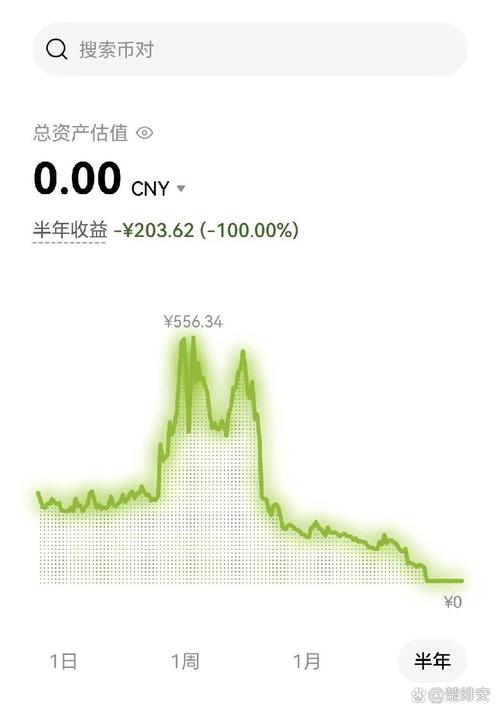

As you analyze the landscape of cryptocurrency markets, the choice of an exchange becomes another pivotal factor. Selecting a reputable exchange that offers low transaction fees, high liquidity, and robust security measures will directly influence your profit margins. Some exchanges even offer integrated wallets that make trading and storage seamless, further minimizing operational complexities.

In conclusion, optimizing Bitcoin profits is not a solitary endeavor; it requires a holistic approach, blending effective hardware selection, strategic hosting choices, diligent maintenance, market adaptability, and carefully chosen exchanges. Each element plays a part—a delicate symphony that harmonizes ambition with technology, yielding bountiful returns for those who diligently navigate the complexities of the cryptocurrency mining landscape.

Leave a Reply